Summary

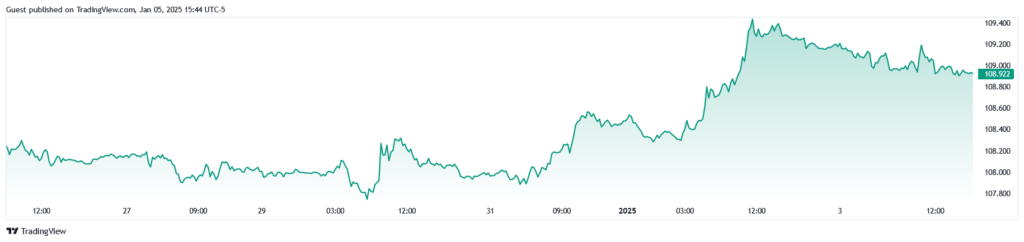

- Gold suddenly appears momentarily correlated with the US Dollar Index.

- If oil producers begin adjusting their pricing strategies or if geopolitical concerns drive commodity prices higher regardless of the dollar’s strength, you could see the emergence of a correlation between COMEX and DXY.

- With post-inauguration chaos, the potential for stealth QE, and the Fed unable to bring down inflation enough to deepen its rate cuts, the price of gold appears ready to take new highs.

cemagraphics

Gold suddenly appears momentarily correlated with the US Dollar Index (DXY). How can gold, a store of value and inflation hedge against dollar inflation, be following the price movements of the same inflationary currency it’s supposed to be protecting you from?

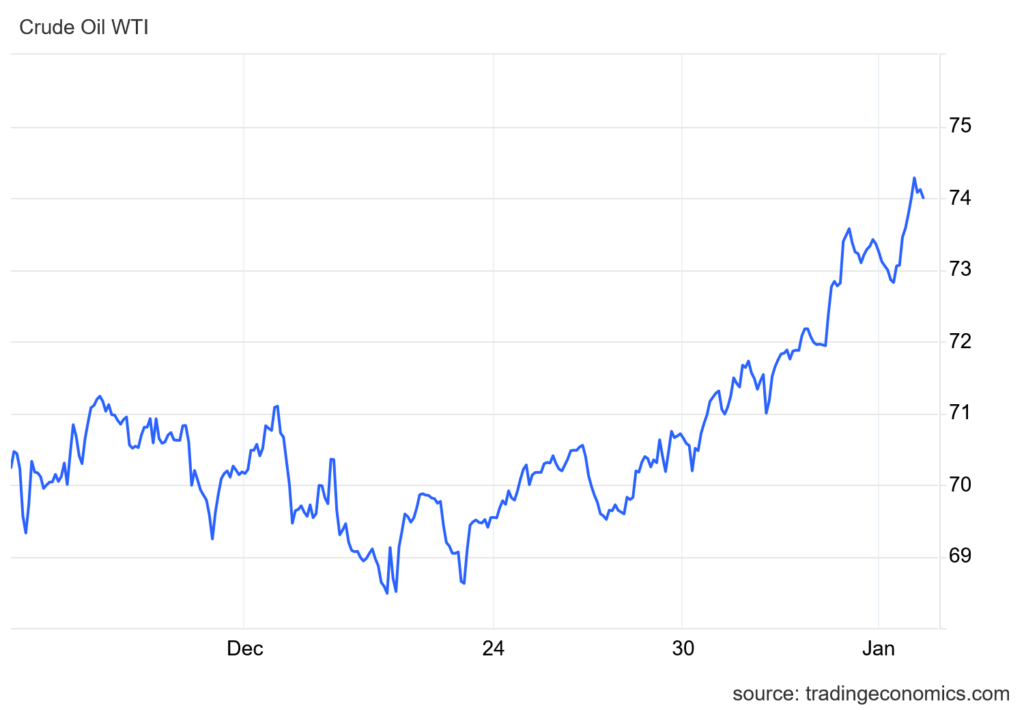

Oil prices are often inversely correlated with the dollar, but if oil producers begin adjusting their pricing strategies or if geopolitical concerns drive commodity prices higher regardless of the dollar’s strength, you could see the emergence of a correlation between COMEX and DXY. Are election-weary markets pricing in the possibility of further escalations in the Middle East? Oil volatility has been relatively low, but prices are on the rise this month as we head toward inauguration day:

Crude Oil, 1-Month

Zoom out. We’re in a wacky, spooky monetary paradigm, and odd things can and do happen in the short-term. But in the longer-term, nature has its way, and economic reality sets in… sometimes violently. Either way, even with a triumphant US dollar, USD is assured to keep losing value relative to the price of commodities like gold—despite some overlap.

Central banks, especially the Federal Reserve, heavily influence both the value of the U.S. dollar and commodities like gold. With tighter monetary policy, the DXY may rise due to higher interest rates, making the dollar more attractive to investors. But if commodities, especially metals like gold, are being bought simultaneously as an inflation hedge, it could create a correlation between the two. If the market sees the tightening as a negative signal for economic growth, commodities could also rise due to fears of stagflation.

DXY 5-Day

Stealth QE through the Treasury could keep adding to the money supply even as the Fed cuts short-term rates, offsetting the effects of more hawkish Fed policy. Even with a slowing pace of cuts, inflation will remain out of control in 2025 no matter what the Fed does. But there’s a push and pull dynamic between Fed tightening and Treasury QE, where it adjusts operations to sell more T-bills over bonds, the Treasury can inject billions or trillions into the market without the Fed. It’s QE through the bond market rather than through monetary policy. Rather than the Fed buying up bonds, the Treasury revisits which bonds it offers on the open market, preferring the sale of short-term debt. If the Treasury sells more short-term bonds, it’s because they expect long-term interest rates to push upward even as inflation rages on.

With post-inauguration chaos, the potential for stealth QE, and the Fed unable to bring down inflation enough to deepen its rate cuts, the price of gold appears ready to take new highs. We are witnessing a changing of the guard as America returns to the most controversial and polarizing presidents in modern American history, fresh off of multiple assassination attempts, in a political comeback with no real precedent, all as embers keep being tossed at multiple powder kegs in the Middle East and Ukraine.

Gold can’t protect you from bombs, assassination attempts, or kamikaze trucks, but it can protect you from economic chaos as more investors flee to monetary safety from inflation, uncertainty, and war.

Shared by Golden State Mint on GoldenStateMint.com